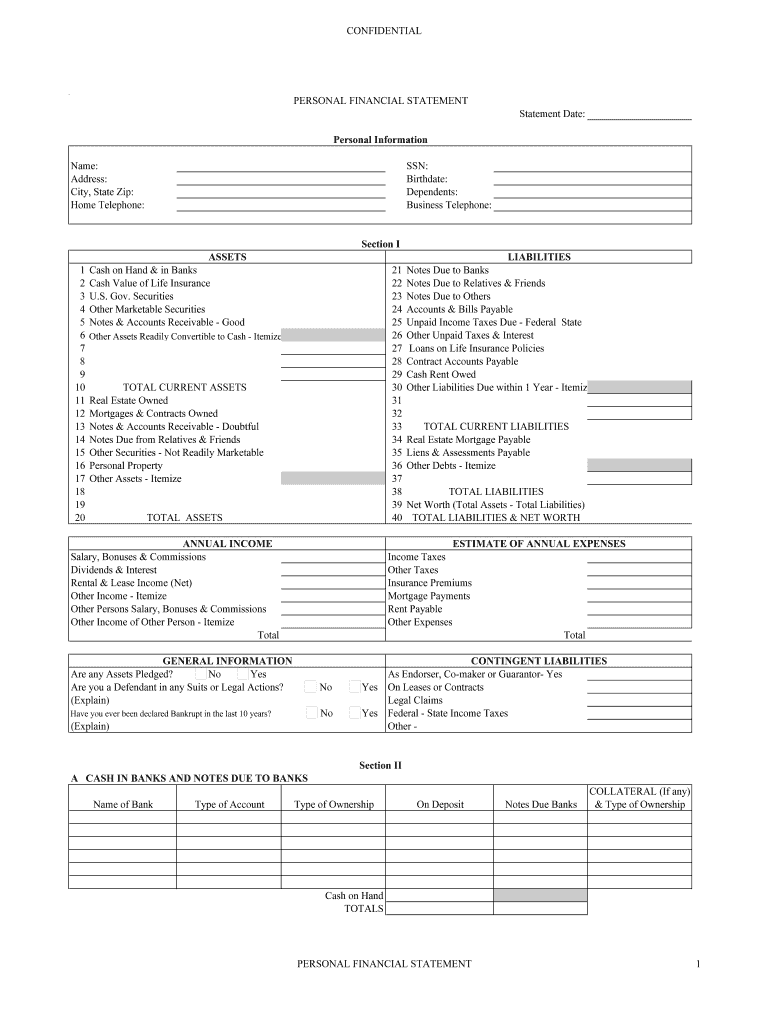

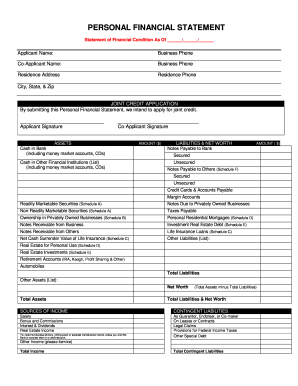

Who needs a fillable personal financial statement form?

Personal financial statement forms are most often used when applying for credit, such as a loan or a mortgage. The form allows credit offers to easily gain an understanding of the applicant’s financial situation in order to make an informed and viable credit decision.

What is a fillable personal financial statement form?

A personal financial statement form will outline an individual's financial situation in any given point in time.

Is the fillable personal financial statement accompanied by other forms?

The personal financial statement is not accompanied by other forms of its kind, however, you may need to submit other required forms if applying for credit.

When is the fillable personal financial statement due?

There is no precise term of validity for the personal financial statement. It is due whenever you are applying for credit.

How do I fill out the fillable personal financial statement form?

The statement asks for information such as:

-

Personal information and data;

A balance sheet, or “statement of financial position”-

-

Assets and Liabilities as listed;

-

Annual income;

-

Annual expenses;

-

Contingent Liabilities- questions should be answered accordingly;

-

General Information;

Notes

This is essentially an appendix in which you provide details about each of the assets and liabilities listed above. This is also the place to describe any miscellaneous liabilities or personal income.

-

Bank accounts and notes due;

-

Life insurance and policies owned;

-

Securities owned;

-

Real estate owned, mortgages owned, personal property owned;

-

Notes;

-

Signature of applicant and lender;

For more information visit your state website or bank.