Personal Financial Statement 1 free printable template

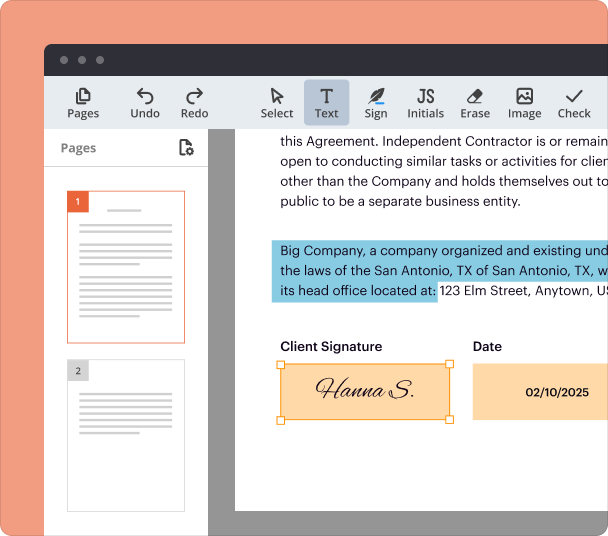

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

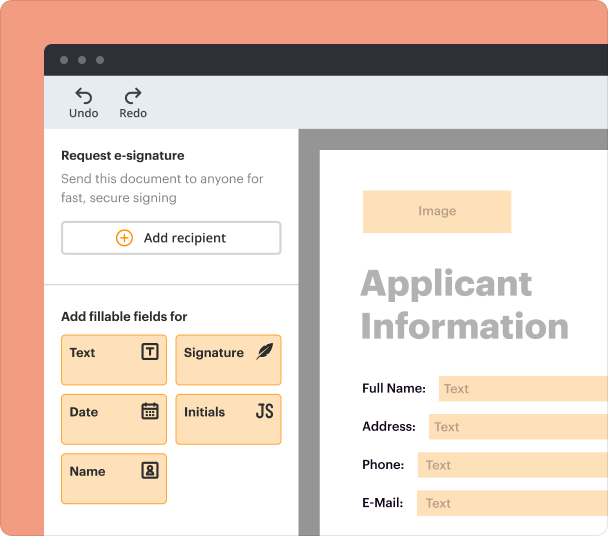

Create professional forms

Simplify data collection

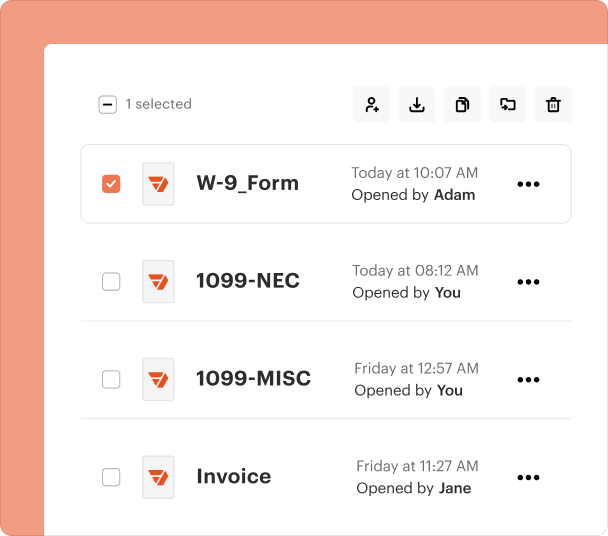

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

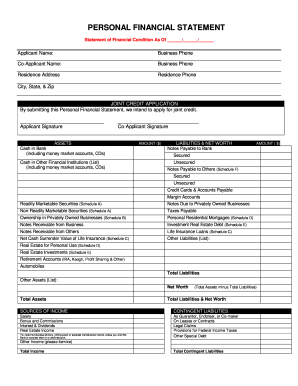

Understanding the Personal Financial Statement 1 Form

What is the personal financial statement 1 form?

The personal financial statement 1 form is a comprehensive document used to capture an individual's financial position. It details assets, liabilities, income, and expenses, providing a snapshot of personal finances. This statement is often used by lenders, financial institutions, and for personal record-keeping.

Key features of the personal financial statement 1 form

This form typically includes sections for listing cash assets, real estate owned, liabilities, and annual income. It may also require information about contingent liabilities and general financial obligations. This structure allows for organized presentation and easy comprehension of one's financial status.

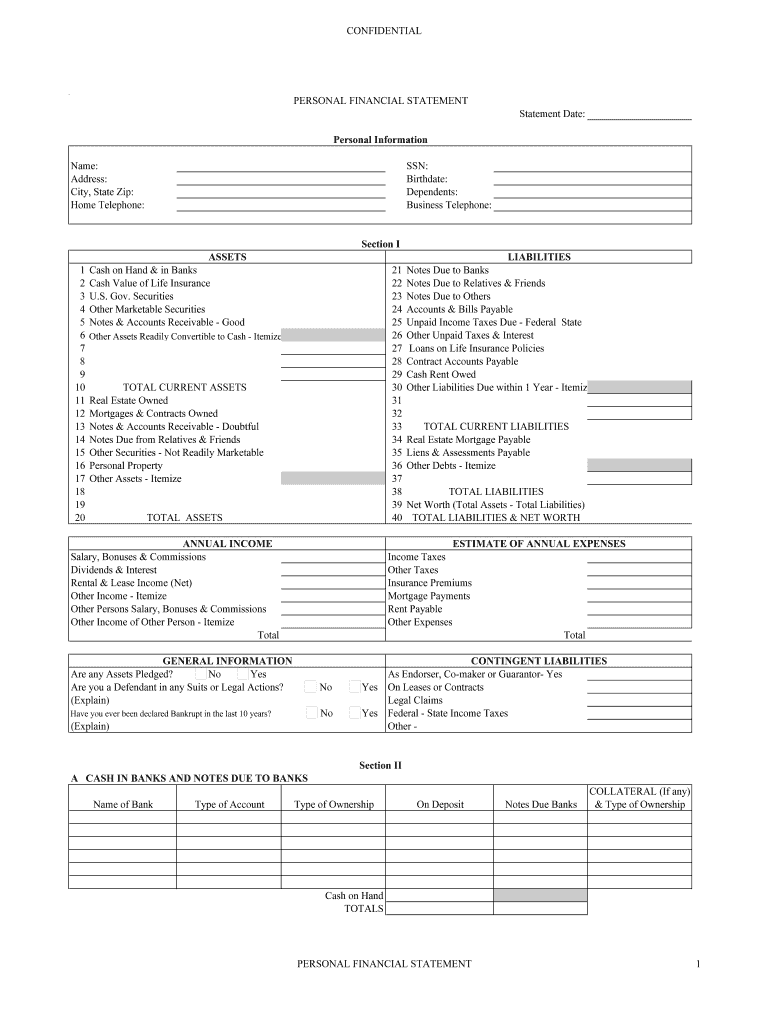

Required documents and information

To complete the personal financial statement 1 form, individuals need to gather documentation regarding their income sources, bank statements, property valuations, and any outstanding debts. This information is essential for accurately reflecting financial health and is often required by lenders for loan applications.

How to fill the personal financial statement 1 form

Completing the personal financial statement involves several steps. First, accurately list all assets, including bank balances and property details. Next, detail any liabilities, such as loans or outstanding accounts. Include yearly income from multiple sources, ensuring all figures are up-to-date. After filling out all sections, it's essential to review the information for accuracy before submission.

Best practices for accurate completion

To ensure the personal financial statement is completed accurately, individuals should keep meticulous records of their finances year-round. Regularly updating their financial data and consulting with a financial advisor can also provide clarity and accuracy. Avoiding estimations and instead using actual figures helps in creating a reliable document.

Common errors and troubleshooting

Common mistakes when filling the personal financial statement often include miscalculating totals, omitting key liabilities, or not updating outdated information. To troubleshoot these issues, it's advisable to double-check each section, possibly have a trusted individual review the form, and ensure that all calculations are correct to minimize errors.

Frequently Asked Questions about personal financial statement form

Who needs the personal financial statement 1 form?

The personal financial statement 1 form is typically required by individuals applying for loans, mortgages, or financial aid, and by investors looking to assess their financial viability.

When should I use the personal financial statement 1 form?

This form is particularly useful during situations involving major financial decisions, such as applying for credit or evaluating personal finances for investment opportunities.

pdfFiller scores top ratings on review platforms